Recently there has been a lot of activity around in-memory database processing. Oracle announced in-memory which it is positioning as a direct competitor to HANA [Fn1]; IBM, Microsoft, and others are getting on the “in-memory” bandwagon as well [FN2]. A quick check of Wikipedia indicates there are numerous companies claiming “in-memory” database processing as well [FN3]. Then there is the huge performance difference between Solid State Drives (SSD) and physical media Hard Drive Disks (HDD), being somewhere around 75 times or greater the Database I/O performance (from about a year ago) [Fn4]. The cost difference for SSD vs Memory is significant and SSD technology is still in its infancy but improving quickly.

This all creates a recipe for “in-memory” database processing becoming a commodity. SAP, there is a forward looking option where you can be strategic about increasing application sales, license revenue, and maintenance revenue. You can do this while making customers happy.

Aren’t “win-win” situations great when they are available?

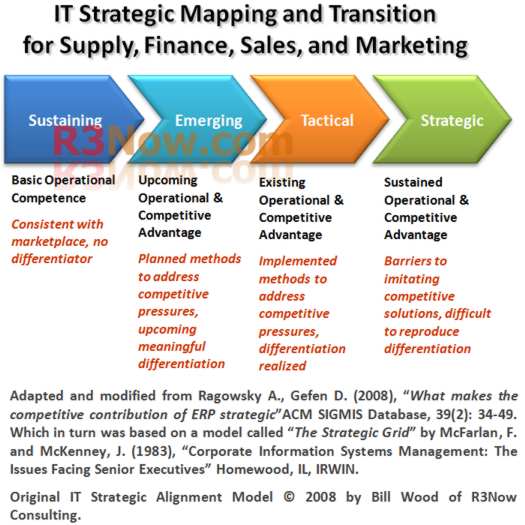

What Does Strategic Mean?

There is so much talk about “strategy” these days that it has become an overused word with little meaning. Too many think strategy means “clever.” While strategy is often “clever” in the business context it has a very specific meaning. Over the years I’ve developed the following model to define the strategic journey for any area of business. In this case, when I refer to strategic sales, I mean that you are creating real barriers to entry and real pressure for competitors.

Strategic Sales Thinking on Managing SAP HANA Competitors

SAP, you have certainly recovered any R&D or development costs invested in HANA. Not only that, you’ve made some money along the way and will continue to leverage HANA as a revenue stream. However, you have a unique, AND NARROW, window of opportunity. As the dominant presence in the “in-memory” space, your opportunity is to limit Oracle’s new database sales growth while still growing your revenue and application footprint with customers. You can use a similar approach to the one I outlined for keeping customers happy and growing revenue in SAP Third Party – Indirect Usage Licensing Part 2. Basically, give customers something of meaningful value while growing your revenue and application footprint. Fence out the competition.

Use HANA to get out in front of Oracle database sales by bundling HANA with certain application and license sales as a “free” application but with some ongoing maintenance fees. You can limit the “amount” of HANA, for example make it the first 1, 2, or 3 64GB units as “free.” For existing customers who may have purchased a promoted combination of application(s) and HANA, provide them some future discount for Net NEW application (or license) purchases. You could also revive your old “safe passage” approach to get existing Oracle installed base customers OFF of the Oracle Database. By giving existing Oracle Database customers an equivalent HANA value to replace their Oracle Databases, but charging maintenance, you create tremendous pressure on Oracle to “cannibalize” their own installed base. This approach does a LOT of things:

- Continued revenue generation by promoting the sale and license growth of existing applications.

- Some revenue generation from HANA maintenance for those customers who accept the bundled version.

- Targeted sale and promotion of the applications SAP as a company wants to more aggressively market such as mobility, CRM, or Business Objects.

- Net NEW database sales by Oracle, or other competitors, are more difficult to position against a MUCH higher performance “free” HANA database application option.

- Establishes a competitive environment where Oracle has to dilute its own sales and marketing efforts to pursue existing customer while competing against HANA adoption for new applications.

- It allows you (SAP) to continue to sell HANA into the existing database space.

- HANA is well positioned as the future defacto In-Memory database (similar to what IBM did with the PC in its early days).

- You create more “stickiness” with any customers using HANA over the rival database companies.

Conclusion for SAP HANA in the Future

HANA’s In-Memory dominance is challenged by numerous competitors entering (or already in) the marketplace. When you combine improvements in SSD performance and cost the pressure grows stronger. Oracle has just finished spending a significant amount of R&D on their In-Memory database product and is preparing to aggressively market it. By providing HANA so that it promotes the sale of the SAP application portfolio, while undermining the viability of new Oracle Database sales, Oracle will struggle to recover R&D while you (SAP) raises their expense to acquire and retain customers.

Done properly Oracle would be placed in a position to cannibalize their own installed base to retain their customer base, all while SAP is left focusing on selling solutions from the SAP application portfolio.

Don’t let this opportunity slip away. You can gain additional application market share while placing your biggest competitor, Oracle, in a difficult competitive situation.

==============

[FN1] Oracle’s In-Memory Option Aims To Beat The Rest Within 12 Months. ZDNet, June 10, 2014. http://www.zdnet.com/oracles-in-memory-option-aims-to-beat-the-rest-within-12-months-7000030382/

[FN2] In-Memory Databases: Do You Need The Speed? Information Week, March 3, 2014. http://www.informationweek.com/big-data/big-data-analytics/in-memory-databases-do-you-need-the-speed/d/d-id/1114076

[FN3] In-Memory Database. Wikipedia, retrieved June 16,2014. http://en.wikipedia.org/wiki/In-memory_database

[FN4] Tom’s Hardware, 2013 HDD Database I/O performance: http://www.tomshardware.com/charts/hdd-charts-2013/-20-IOMeter-2006.07.27-Database,2922.html; SSD Database I/O Performance: http://www.tomshardware.com/charts/ssd-charts-2013/IOMeter-Database-Benchmark,2817.html. retrieved June 16,2014

Hi Dennis, I did make a short reference to my proposed solution for customers who have already purchased but I probably should have fleshed it out a little more.

“For existing customers who may have purchased a promoted combination of application(s) and HANA, provide them some future discount for Net NEW application (or license) purchases. As another type of sales alternative you could use something like your old “safe passage” approach to get existing Oracle installed base customers OFF of the Oracle Database.”

SAP could also provide a “safe passage” credit for other vendor’s applications some customers have to replace them with SAP applications. In other words, there are creative ways SAP could make previous customer purchases whole so that they gain incremental revenue and the customer gains greater application portfolio value.

Missed the last part about the analysts taking HANA revenues out. If I were “king for a day” and could make the decision, as noted in the post, I would not eliminate HANA sales. HANA sales would be targeted differently.

– HANA would be bundled only with certain targeted products (it would still be sold)

– Sales would also target existing Oracle, MS, IBM, and other DB installed base customers.

– Since SAP licenses HANA in 64GB blocks, they could make “x” amount free as part of an application bundle and over that there would be a charge.

In other words there are a lot of potential options that would *not* significantly disrupt sales revenue. In fact, using some of these approaches would naturally create wider adoption and with that adoption there may be incremental revenue growth above current targets.

Remember here, aside from the competitive issues raised in the post there are also several barriers to customer adoption: new memory based infrastructure costs, platform transitions, CAPEX outlays, etc. SAP would still gain revenue from OPEX in the form of some maintenance but lowering the CAPEX outlay might lower the barriers enough for significantly greater market penetration.

What would you say to all those who paid through the nose for HANA so far? Would you refund money to them and take a big one-time charge? Would you say “sorry for supporting us?” And what will happen to the SAP stock price when the Wall Street and Bourse analysts take future HANA revenues out of their models?

– Dennis Moore